by Gabor Zavodszky | Jul 25, 2023 | Hot News, News

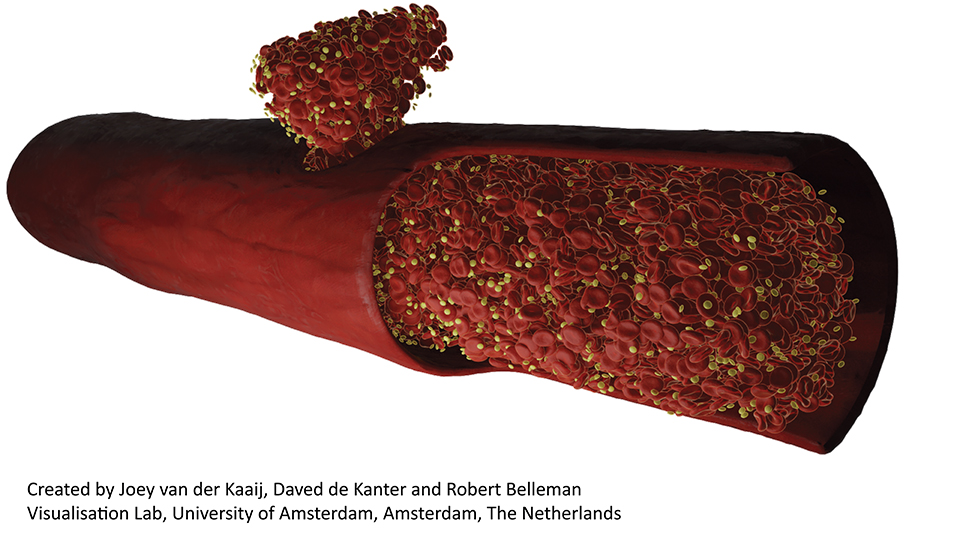

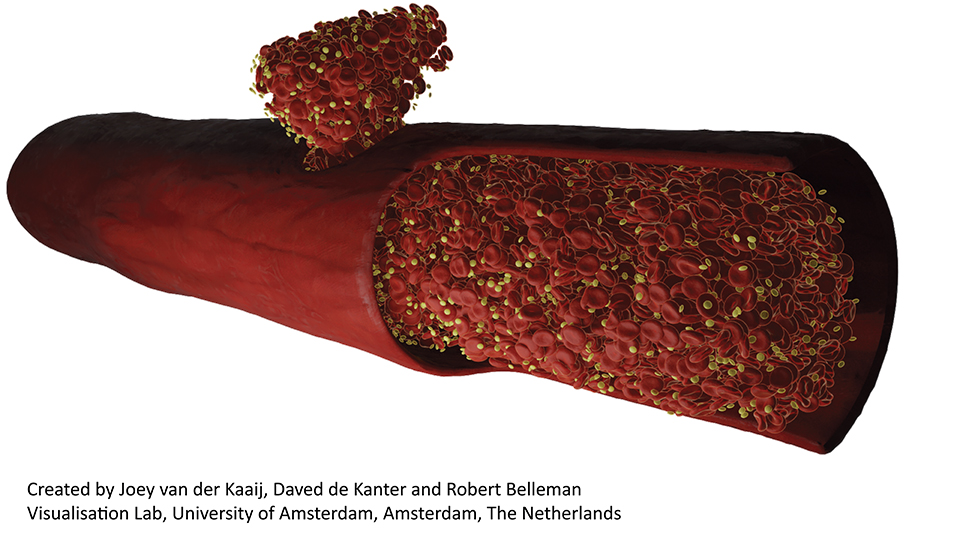

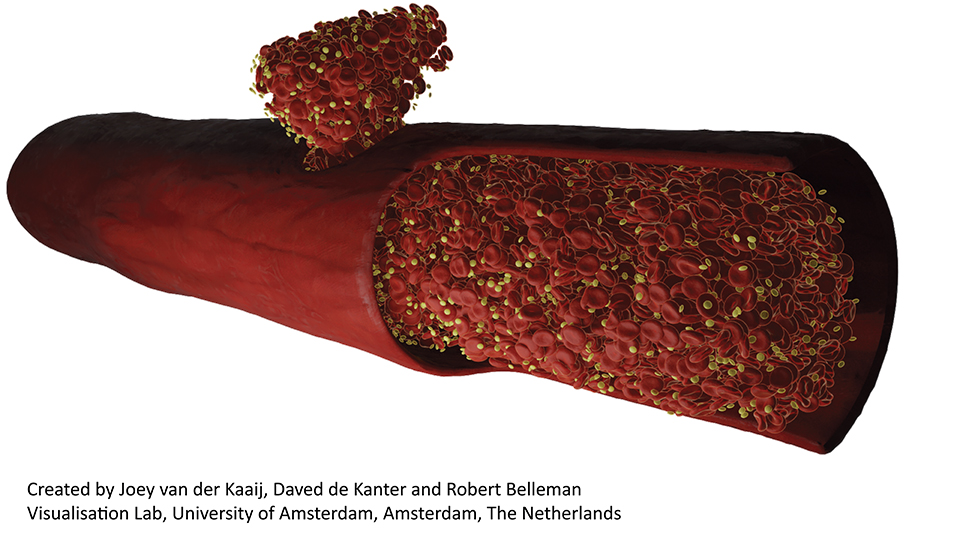

Christian Spieker, Gábor Závodszky & Alfons Hoekstra have published a new paper in Physics of Fluids that became a featured article and was published in combination with a Scilight article. When receiving a bleeding injury, the body defends itself by triggering...

by Gabor Zavodszky | Jul 25, 2023 | Hot News, News

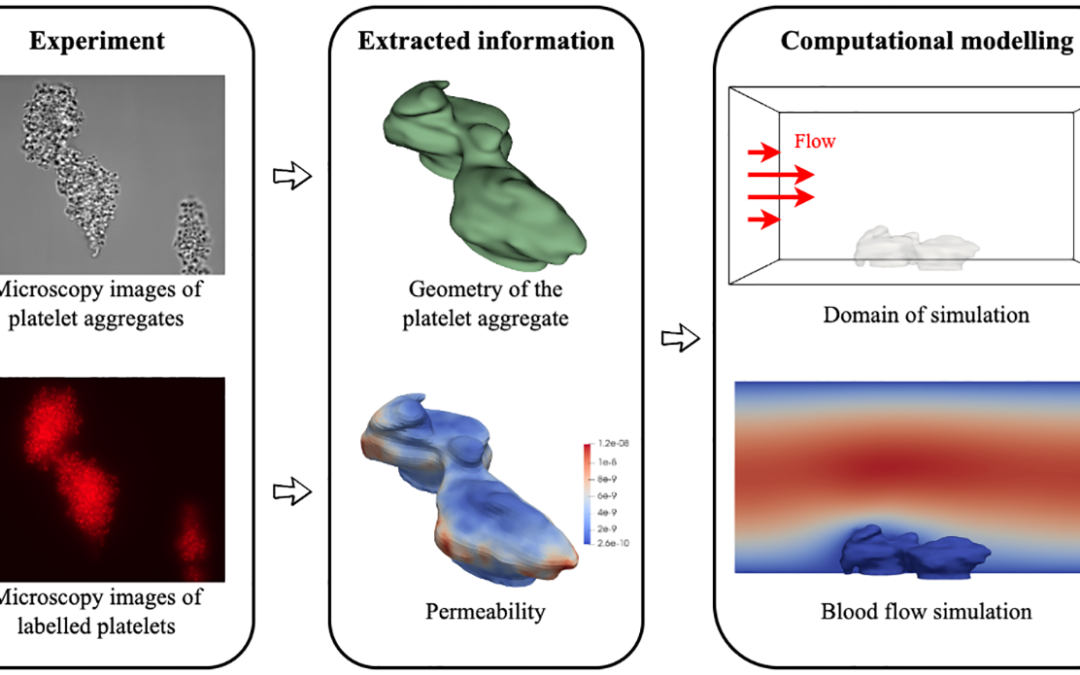

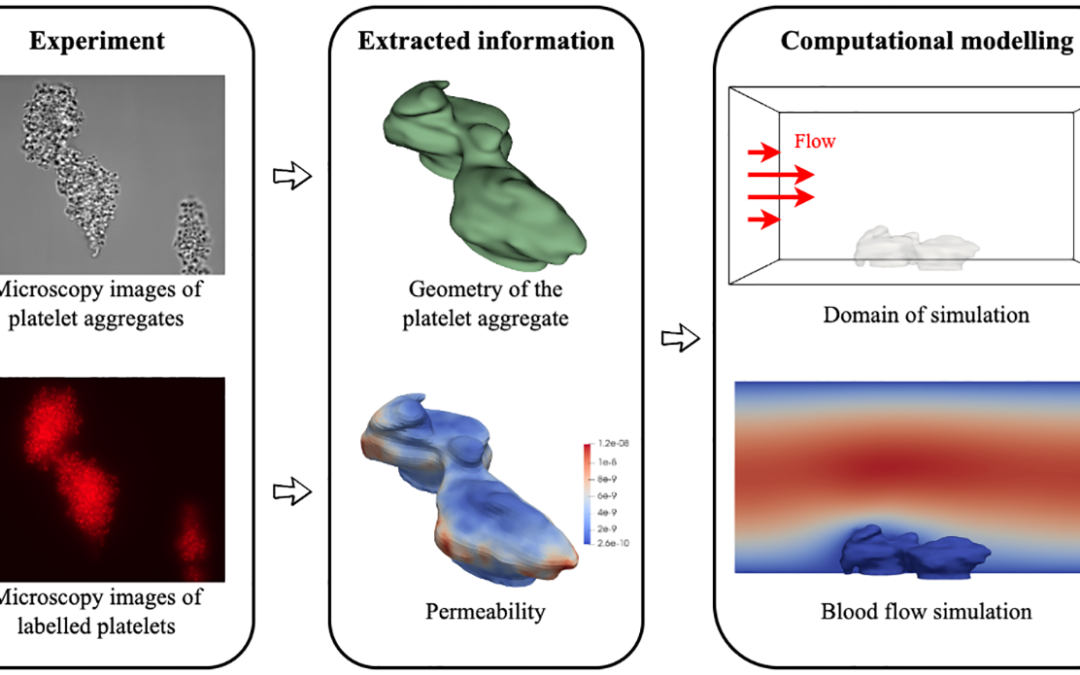

Yue Hao, Gábor Závodszky & Alfons Hoekstra have published a new paper in PLOS Computational Biology on building image based simulations of platelet aggregates. Hemodynamics is crucial for the activation and aggregation of platelets in response to flow-induced...

by Gabor Zavodszky | Mar 22, 2022 | Hot News, News

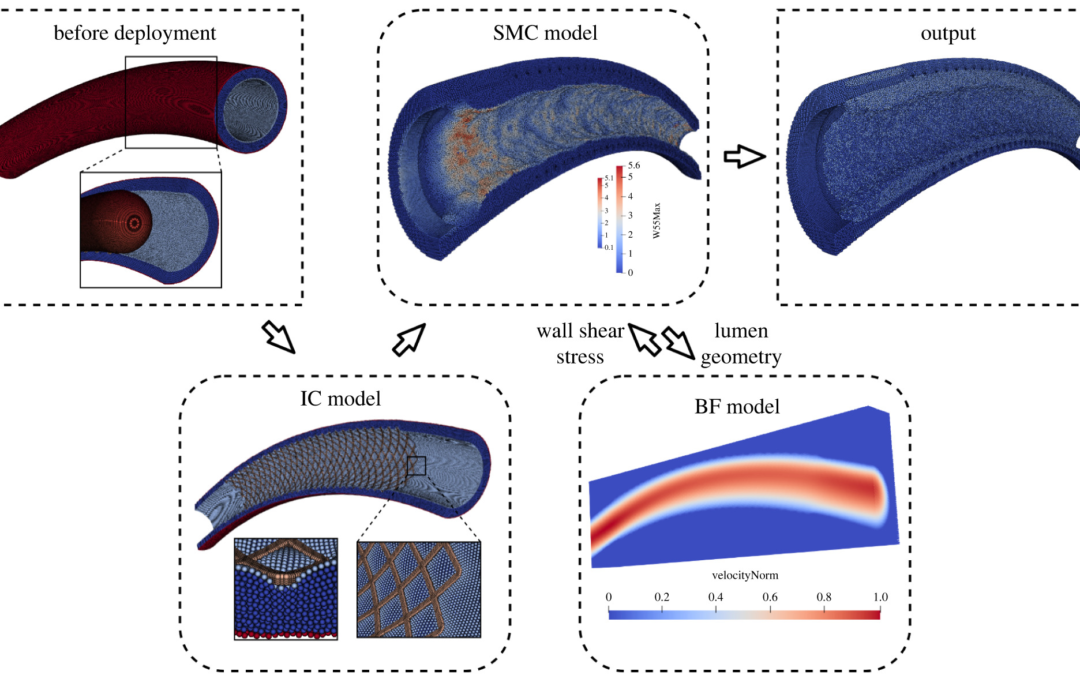

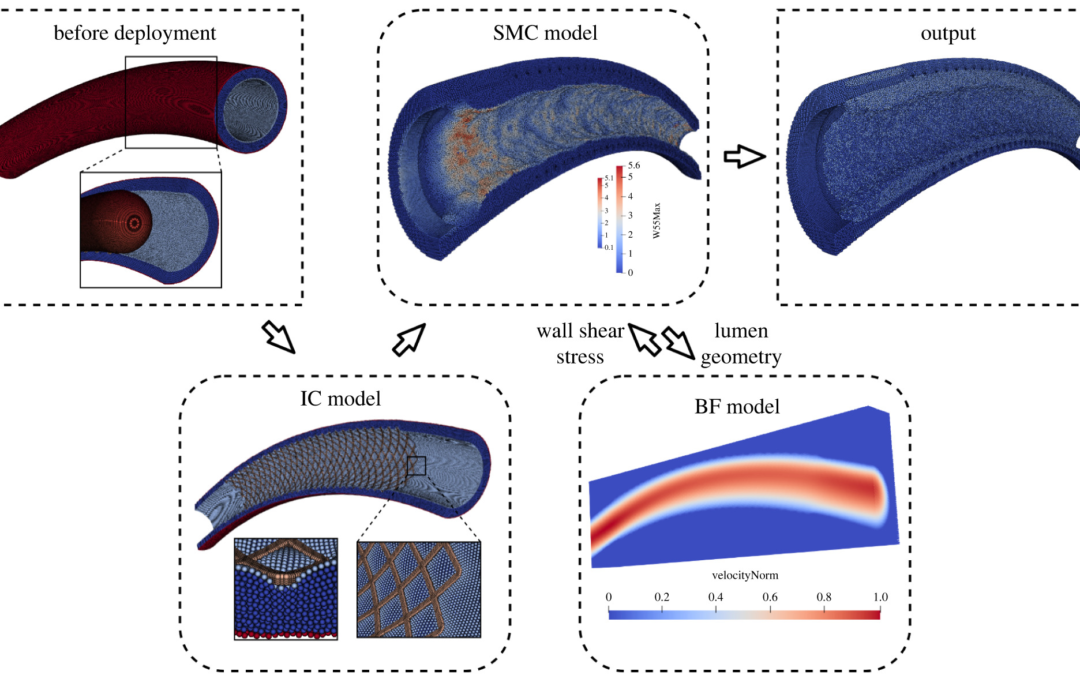

Dongwei Ye, Pavel Zun, Valeria Krzhizhanovskaya and Alfons G. Hoekstra have published a new paper on the uncertainty quantification of a 3D in-stent restenosis model in the Journal of the Royal Society Interface. In-Stent Restenosis is a recurrence of coronary artery...

by Gabor Zavodszky | Oct 27, 2021 | Hot News, News

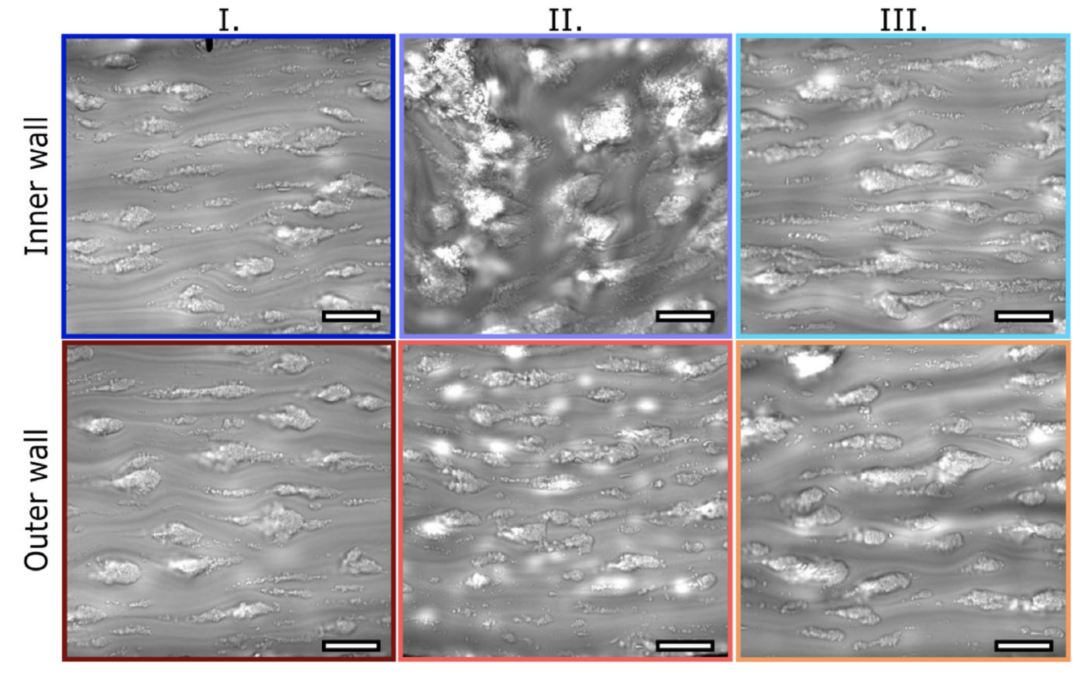

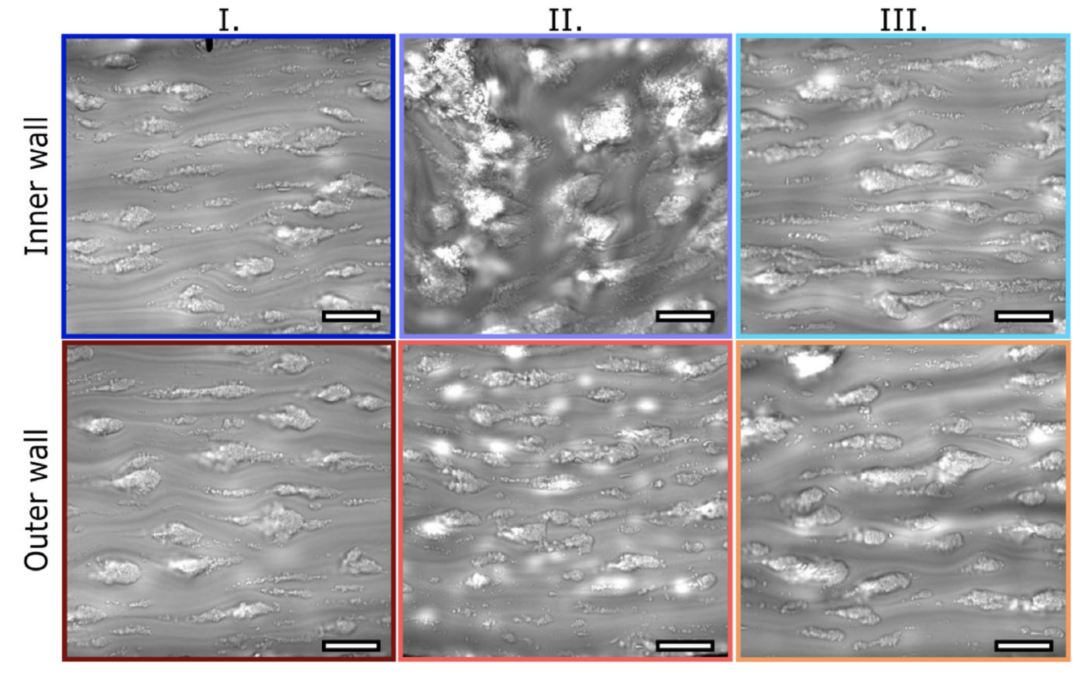

Christian Spieker, Gábor Závodszky, Max van der Kolk & Alfons Hoekstra have published a new paper on the effects of local vessel curvature on platelet adhesion in the Virtual Physiological Human special issue of the Annals of Biomedical Engineering. The emerging...

by Gabor Zavodszky | Jul 22, 2021 | Jobs, News

We are seeking a highly motivated candidate to work on the use of classical spin models for high order pattern detection and information coding in binary data. In this context, recent studies have highlighted the existence of linear transformations (called gauge...