According to Basel III, financial institutions need to charge a Credit Valuation Adjustment (CVA) to account for counterparty default risk. This adjustment is typically driven by a large number of uncertain risk factors, which makes efficient computation of CVA and the corresponding risk measures a complex mathematical and numerical modelling problem.

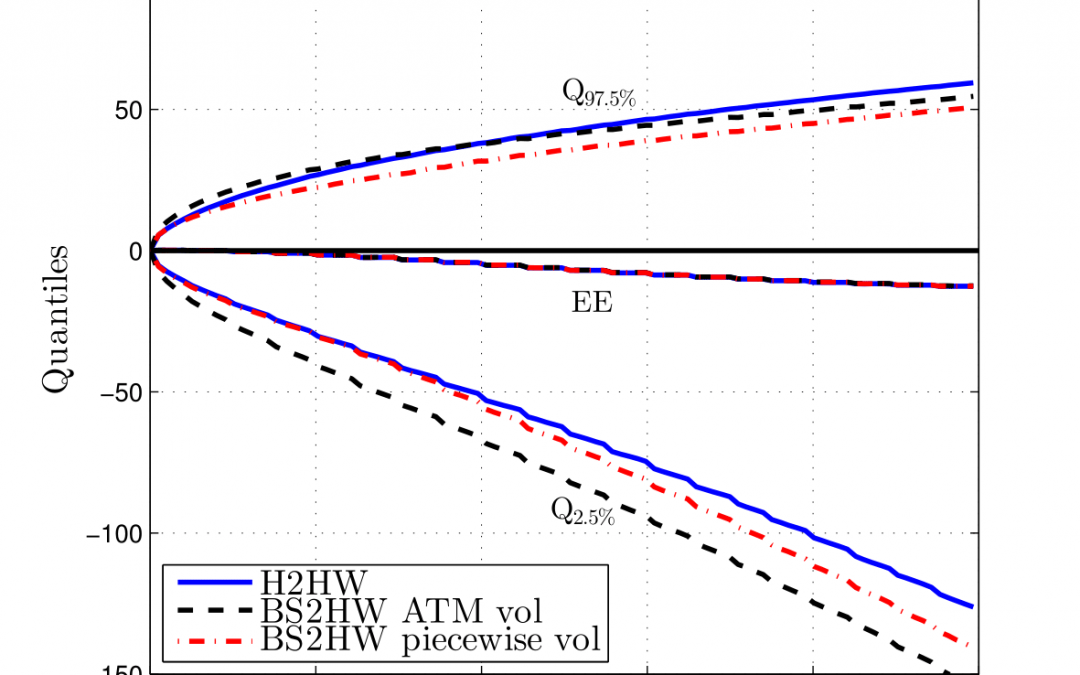

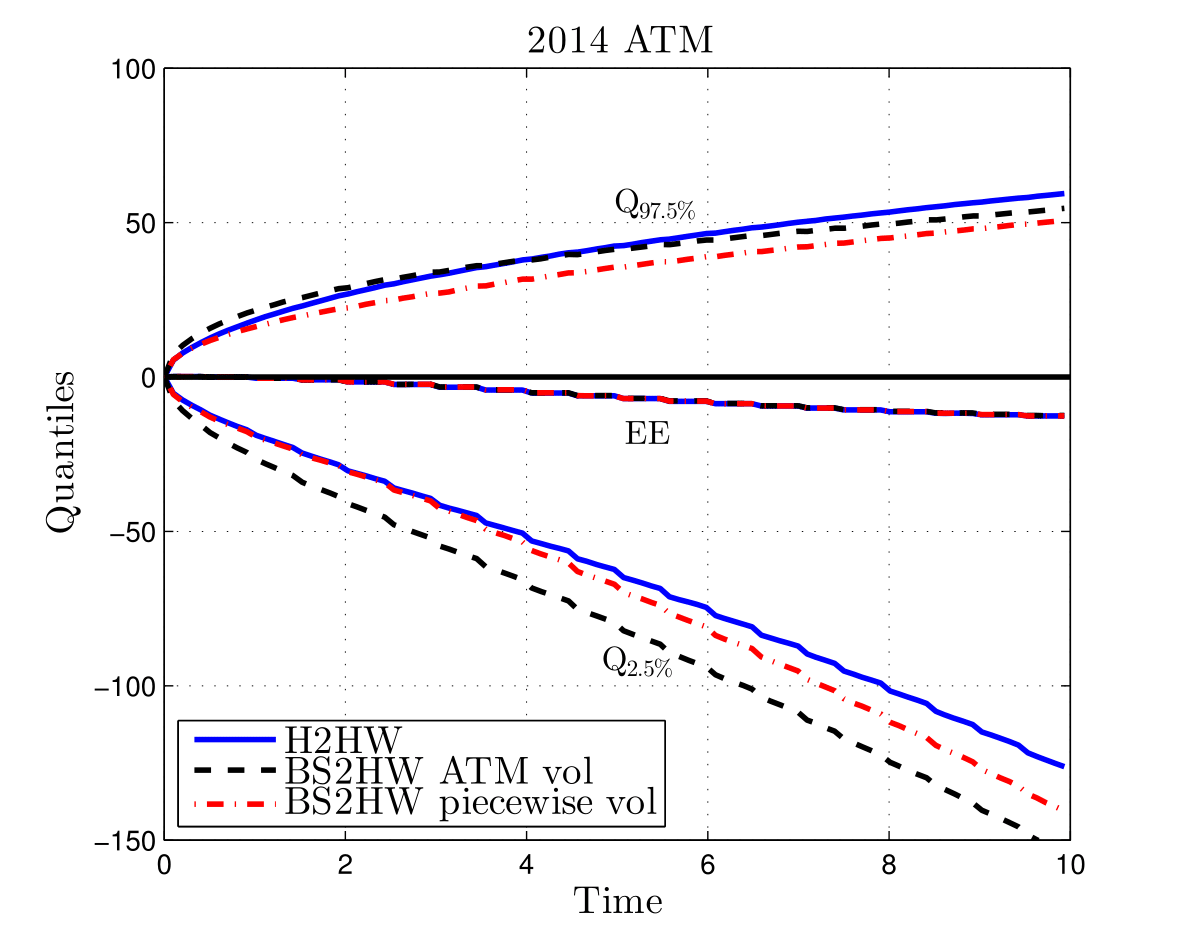

In “Smile and default: the role of stochastic volatility and interest rates in counterparty credit risk” (S. Simaitis 2016), published in Quantitative Finance, Kees de Graaf et al., applied this method to study the complex multi-dimensional problem of the role of fat-tailed distributions of underlying correlated risk factors on default risk. Their studies confirmed that deviations from normality of asset prices significantly impacts exposure dynamics. In particular, for more complex path-dependent derivatives, the risk measures become highly model-dependent.

Citation info: S. Simaitis, C.S.L. de Graaf, B.D. Kandhai and N. Hari. 2016. “Smile and default: the role of stochastic volatility and interest rates in counterparty credit risk.” Quantitative Finance 1725-1740.