Ioannis Anagnostou and Prof. Drona Kandhai have published and article on risk factor evolution for counterparty credit risk under a hidden Markov model in Risks https://doi.org/10.3390/risks7020066.

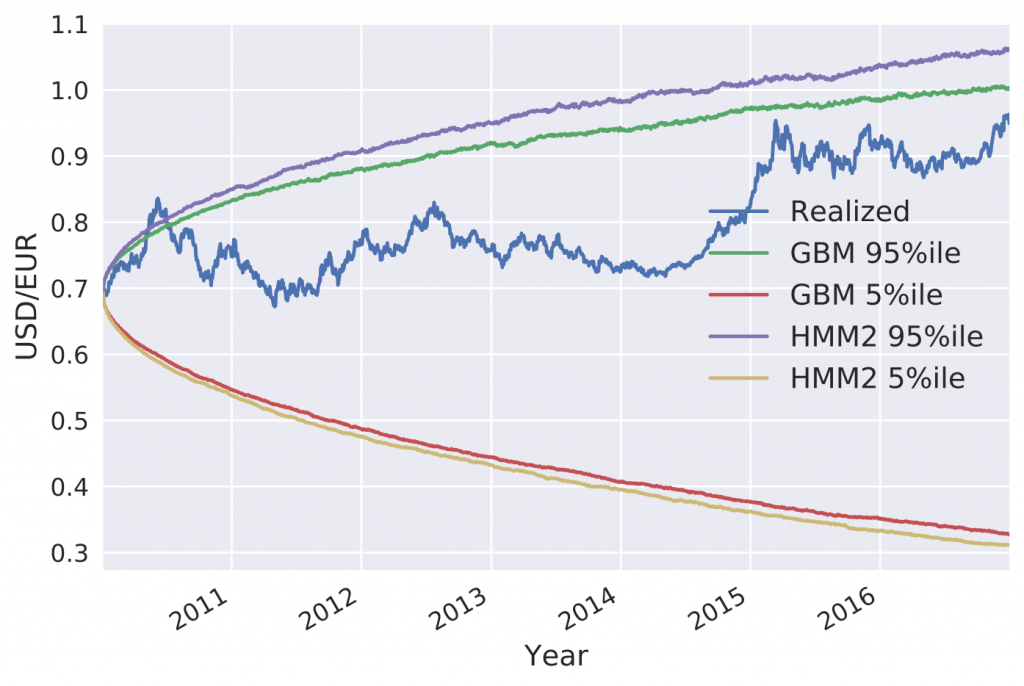

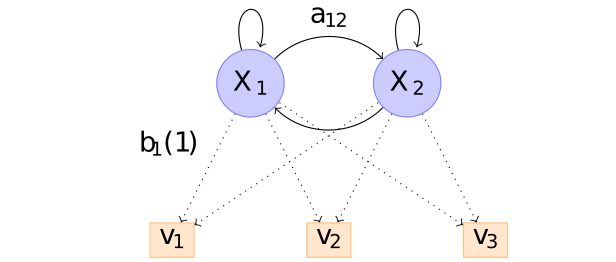

As a response to the recent financial crisis, banks are required to hold capital against their exposures to all counterparties in over-the-counter derivative transactions. A key component of counterparty exposure measurement is generating scenarios for the underlying risk factors such as interest and exchange rates. In this work, Anagnostou and Kandhai propose a model for the evolution of exchange rates, where the drift and volatility are able to switch between regimes. The main motivation of using such a model is the fact that geometric Brownian motion – the most popular modelling approach for exchange rates – can assign unrealistically low probabilities to extreme scenarios, leading to the under-estimation of counterparty exposure and the corresponding capital. The proposed model is able to produce distributions with heavier tails and capture extreme movements without entirely departing from the convenient geometric Brownian motion framework. Scenarios are generated for a number of exchange rates and the models are backtested in accordance with the recent regulatory requirements. The impact of using a hidden Markov model on counterparty exposure is found to be profound for derivatives with non-linear payoffs. The study highlights some of the limitations of backtesting as a tool for model comparison, since models with similar performances in a backtesting exercise can result in very different exposure values and, consequently, in very different capital buffers. This can lead to regulatory arbitrage and potentially weaken financial stability and, further, turn into a systemic risk.